ADA Price Prediction: Will Cardano Rebound or Decline Further?

#ADA

- Technical Outlook: MACD bullish, but price below 20-day MA signals short-term weakness.

- Market Sentiment: Divided between whale-driven caution and ETF/news optimism.

- Key Levels: $0.80 (support) and $0.8598 (20-day MA) are critical for trend confirmation.

ADA Price Prediction

ADA Technical Analysis: Key Indicators to Watch

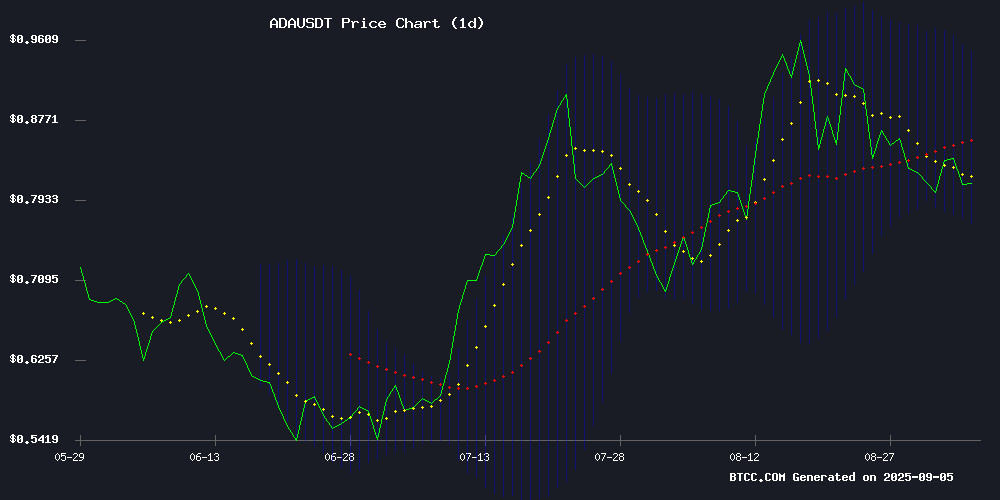

According to BTCC financial analyst Mia, ADA is currently trading at $0.8243, below its 20-day moving average (MA) of $0.8598, indicating short-term bearish pressure. The MACD shows a bullish crossover with the signal line at 0.0157 and the MACD line at 0.0422, suggesting potential upward momentum. Bollinger Bands reveal ADA is NEAR the lower band ($0.7711), which could act as support. A breakout above the middle band ($0.8598) may signal a trend reversal.

ADA Market Sentiment: Mixed Signals Amid Volatility

BTCC financial analyst Mia notes that Cardano's market sentiment is divided. While whale activity and a dip to 5-month lows suggest caution, bullish factors like the $0.80 support level and ETF news provide optimism. Allegations against Cardano's founder being cleared may restore confidence, but ADA's consolidation near $0.82 reflects uncertainty. Mia emphasizes monitoring key technical levels for clearer direction.

Factors Influencing ADA’s Price

Cardano Whales On The Move As Sentiment Dips To 5-Month Lows

Cardano's crowd sentiment has retreated to its lowest level in five months, signaling a bearish outlook among retail investors. Despite this, whale demand for ADA has surged over the past two days, suggesting accumulation at discounted prices.

The Clarity Act's recognition of Cardano as a top-three network likely to mature under U.S. regulatory standards adds institutional credibility. ADA's price action shows a 20% retreat from August highs but maintains a 9% monthly gain, with technical indicators pointing to potential support at $0.82.

Market analysts note the divergence between weakening retail sentiment and strengthening on-chain metrics. The Money Flow Index confirms sustained liquidity inflows since June, while a wedge pattern suggests imminent price volatility.

Cardano (ADA) Faces Bearish Pressure Amid Market Volatility

Cardano (ADA), the tenth-largest cryptocurrency by market capitalization, is grappling with bearish momentum as market volatility persists. Trading at $0.8202, ADA has declined 1.6% over the past 24 hours, testing a critical resistance level near $0.8429. A breakout above this threshold could propel the altcoin toward $0.8500, while failure to hold support at $0.8139 may trigger a drop to $0.7500.

Technical indicators paint a cautious picture. The Moving Average Convergence Divergence (MACD) shows a bearish crossover, and the Relative Strength Index (RSI) suggests weakening momentum. With a 24-hour trading volume of $847.63 billion against a market cap of $29.31 billion, ADA's near-term trajectory hinges on broader market sentiment.

Cardano (ADA) Eyes Breakout as $0.80 Support and ETF News Boost Momentum

Cardano's ADA is gaining traction as institutional interest surges following Grayscale's filing for an ADA exchange-traded fund with the SEC. The potential approval could provide investors with regulated exposure to Cardano, enhancing its liquidity and adoption in traditional finance.

ADA's price action shows resilience, holding above the critical $0.80 support level. At $0.8271, the token has posted modest gains of 0.9% over 24 hours and 0.29% weekly, with a market capitalization nearing $30 billion. Analysts suggest that sustained momentum could push ADA toward higher resistance levels.

The broader market shift from bearish to bullish sentiment is lifting major cryptocurrencies, with Cardano positioned as a standout beneficiary of both technical strength and fundamental developments.

Cardano (ADA) Price Eyes $1.47 to $1.79 After Strong Market Momentum

Cardano's ADA token is gaining traction as market momentum builds, with analysts eyeing a potential breakout toward the $1.47–$1.79 range. The $1 resistance level remains pivotal—a decisive breach could signal accelerated upward movement.

Trading at $0.8257, ADA has posted a 1.03% gain over 24 hours, backed by $1.36 billion in volume. Analysts suggest the token may be entering a parabolic phase, historically indicative of rapid price appreciation.

Market observers highlight the Wyckoff cycle's influence, with Mintern noting early signs of vigorous upside. The coming days could prove decisive for ADA's trajectory.

Cardano ADA Price Forecast: Divergent Views on 2025 Trajectory Amid Current Accumulation Phase

Cardano's ADA trades at $0.8088, down 4.04% in 24 hours as volume contracts to $854 million. The $0.70-$0.80 range emerges as a contested accumulation zone, with CryptoPulse noting 'smart money' positioning for a future breakout.

Analysts remain split on 2025 projections, with DigitalCoinPrice forecasting a rebound to $1.78 this year while broader estimates span $0.77 to $3.10. Market apprehension persists despite accumulating signals of long-term bullish potential.

Cardano (ADA) Consolidates Near $0.82 Amid Mixed Technical Signals

Cardano's ADA hovered around $0.82 in subdued trading, with technical indicators offering conflicting signals about its next directional move. The digital asset slipped 0.04% over 24 hours as trading volumes reached $63.3 million on Binance spot markets.

Market participants found little clarity in the neutral Relative Strength Index reading of 46.80, which suggested equilibrium between buyers and sellers. The absence of fundamental catalysts left the cryptocurrency at the mercy of technical factors, with analysts eyeing potential support tests as momentum indicators turned bearish.

Trading ranges tightened between $0.80 and $0.82, characteristic of consolidation phases that often precede decisive price movements. Such compression periods typically resolve with increased volatility, though the direction remains uncertain given the current technical crosscurrents.

ADA Price Prediction: Cardano Eyes $1.32 Target as Technical Breakout Builds

Cardano (ADA) is showing signs of a bullish breakout, with analysts predicting a potential 61% surge to $1.32 within 4-6 weeks. The cryptocurrency has broken free from a falling wedge pattern, with key resistance now at $1.02. Current trading levels hover around $0.95, marking a 16% increase, while the projected range stretches from $1.10 to $1.32.

Market sentiment is overwhelmingly optimistic, with PricePredictions.com forecasting a medium-term target of $2.95—a 250% upside. More conservative estimates from Coinpedia and CryptoPredictions.com converge at $1.32, suggesting strong technical resistance at that level. Short-term predictions vary widely, reflecting ADA's current consolidation phase, with targets ranging from $0.76 to $1.04.

The technical setup indicates growing momentum, positioning Cardano for a decisive move. Traders are watching the $1.02 resistance level closely, as a breakout could confirm the bullish trajectory.

Forensic Report Clears Cardano’s ADA Voucher Program of Fraud Allegations

An independent forensic investigation has found no evidence of fraud or misconduct in Cardano’s decade-old ADA Voucher Program. The report, conducted by law firm McDermott Will & Emery and accounting firm BDO, refutes claims of insider misuse, blockchain manipulation, or improper diversion of unredeemed tokens.

The review examined 14,282 vouchers, representing 99.7% of all ADA sold, with successful redemptions through on-chain processes and a recovery initiative. Only 6.1% of vouchers were sold to individuals over 65, with just 14 remaining unredeemed. Safeguards were in place to prevent misrepresentation, and rule-breaking distributors were suspended.

Unclaimed vouchers from Cardano’s Byron-era redemption process totaled 390, worth 318 million ADA. Input Output’s follow-up efforts aimed to address remaining redemptions, reinforcing transparency in the program’s execution.

Cardano (ADA) Price To Rebound After Prolonged Decline, All You Need To Know

Cardano's ADA shows signs of a potential rebound as the TD Sequential indicator flashes a "9" buy signal, historically marking the end of bearish trends. The token tested resistance near $0.84, with analysts eyeing $1.00 if bullish momentum holds.

At press time, ADA traded at $0.8082, down 3.79% on the day but up 12% monthly. Trading volume remained robust at $1.5 billion, with market watchers noting a critical resistance zone between $0.83-$0.86. A daily close above $0.86 could pave the way for higher targets.

Cardano Founder Cleared of Misappropriation Allegations as ADA Price Dips to $0.80

An independent audit has exonerated Cardano founder Charles Hoskinson from allegations of misusing 318 million ADA tokens, worth $619 million at the time. The claims, made by X user Masato Alexander in May 2025, suggested improper fund movements during Cardano's 2021 "Allegra" Hard Fork. The audit, released on Sept. 3, confirmed all transactions followed established protocols.

Hoskinson countered the accusations on May 7, explaining that unredeemed ADA vouchers were lawfully returned to the Token Generation Entity and donated to Intersect. Despite the clearance, Cardano's price fell to $0.80, underscoring market sensitivity to governance concerns in decentralized ecosystems.

Is ADA a good investment?

BTCC analyst Mia suggests ADA presents a high-risk, high-reward opportunity. Below is a summary of key data:

| Metric | Value |

|---|---|

| Current Price | $0.8243 |

| 20-Day MA | $0.8598 |

| MACD | Bullish (0.0422) |

| Bollinger Bands | $0.7711–$0.9486 |

While technicals hint at a potential rebound, mixed news sentiment warrants caution. Investors should consider their risk tolerance and watch the $0.80 support level.